There are a lot of possible reasons why you may be reluctant to make a will – you may think that creating one would be too complicated, or too morbid. However, writing a will can make things much easier for your family after you pass away, particularly if you have considerable assets to pass on.

Why you should make a will

Avoid intestacy

If you die without a valid will, you are considered to have died intestate. This means that all of your assets will be distributed under what are known as the rules of intestacy, and you and your surviving family and friends will have no say in what is done with them (unless your survivors launch a legal challenge).

Under the rules of intestacy, only close relatives, such as your spouse, civil partner, or children can inherit from your estate. This is decided according to a strict hierarchy, with your spouse or partner at the top, followed by your children, parents, siblings, grandparents, and uncles or aunts.

This means that if you die intestate, you will not be able to leave anything for a common law spouse or your stepchildren. You will also be unable to leave a donation to a charity of your choosing.

Taking care of your children

As well as outlining where you would like your money, property and any possessions to go, it is also possible to specify your wishes for what should happen to your children if you and their other parent or guardian passes away. You can nominate a guardian to take care of your children until they turn 18 in your will.

Choose your executors

The executors are the people who will be responsible for carrying out your final wishes, executing the will and taking care of other probate matters, such as dealing with inheritance tax.

You can specify the executors in your will, giving the role to those you feel would be most capable of handling the responsibility. Your specified executors are not legally bound to act as executors – if they decide that they can’t or don’t want to take care of it, they could leave it to a solicitor or the other executors.

Minimise inheritance tax

Inheritance tax is paid on any amount of your estate that exceeds £325,000. The inheritance tax rate is 40%, so if your estate is worth considerably more than £325,000, this can amount to a large chunk of your family’s inheritance.

However, there are ways to set up your will which can help to reduce the amount of inheritance tax that must be paid. A professional will writer or solicitor can give you more information on this.

Different types of wills

Before you get started on your will, you should give some thought to what type of will you need. There are a number of different types, each of which is designed to cover different eventualities and situations.

Single and Mirror Wills

A single will is what you probably think of when you hear the word ‘will’ – a document created by one person, regardless of marital or relationship status, which lays out their wishes after death and how they would like their estate to be distributed.

Mirror wills serve the same purpose but are designed for couples who have identical or very similar wishes. Because the wording of the two wills is unlikely to differ much, mirror wills are generally a far better deal than buying a single will for each partner separately. Mirror wills can be purchased by couples whether they are married, in a civil partnership or even unmarried.

Using a single will, or a set of mirror wills, you can establish the executors who will manage the distribution of your estate after your death, appoint guardians for children and set out who should inherit sums of money or specific possessions. You are also able to state if you wish to leave any money to charities, and express your wishes with regard to funeral arrangements.

Trusts in wills

Creating a trust in your will is complicated and there are different types of trusts. A trust is simply where you appoint individuals to look after your assets on behalf of someone else. It is recommended that you seek legal advice before creating a trust.

Property trust wills are intended for use by people who have a particular interest in protecting a property’s value for future generations. For example, you may want to ensure your property (or part of) is not used to pay for care home fees for the surviving spouse or to ensure your home is passed onto future generations.

Flexible interest trust wills

Flexible interest trust wills are similar to property trust wills insofar as they protect one’s property, but offer additional security for those who also have a large amount in savings. Flexible interest trust wills are set up so that you can support your surviving partner (or another person) until they pass away with the income generated by your investments, while simultaneously ensuring that the capital invested is protected for your offspring to inherit. It also works the same as a property trust will in preventing your property from losing value.

Discretionary trust wills

In addition to performing the same functions as a normal will, a discretionary trust will allow you to ensure that you can leave money to those who may not be suited to receive it directly. This is done by appointing trustees – reliable people who can deal with the inheritance and make good use of it on the beneficiary’s behalf.

Making a discretionary trust will gives the peace of mind that comes with knowing that those loved ones who may need assistance with handling their finances will be provided for after your death, and that the decisions made for them will be in their best interests. However, it’s important to remember that in a discretionary trust will, it will be your trustees who decide who gets what and how much, not you. If you want to say exactly how much each person gets then this is not the right choice for you.

A discretionary trust will may be suitable for leaving money to:

- Those who are not mentally or physically able to deal with their own financial affairs;

- Those who are in financial trouble or severe debt;

- Those who receive disability benefits which could be reduced or eliminated if they were to come into money.

How to make a will

If you are looking to make a will, you can get the help of a solicitor or dedicated will writer to help you put one together. Alternatively, you can make you own will, and you can find out more about this option in the section below.

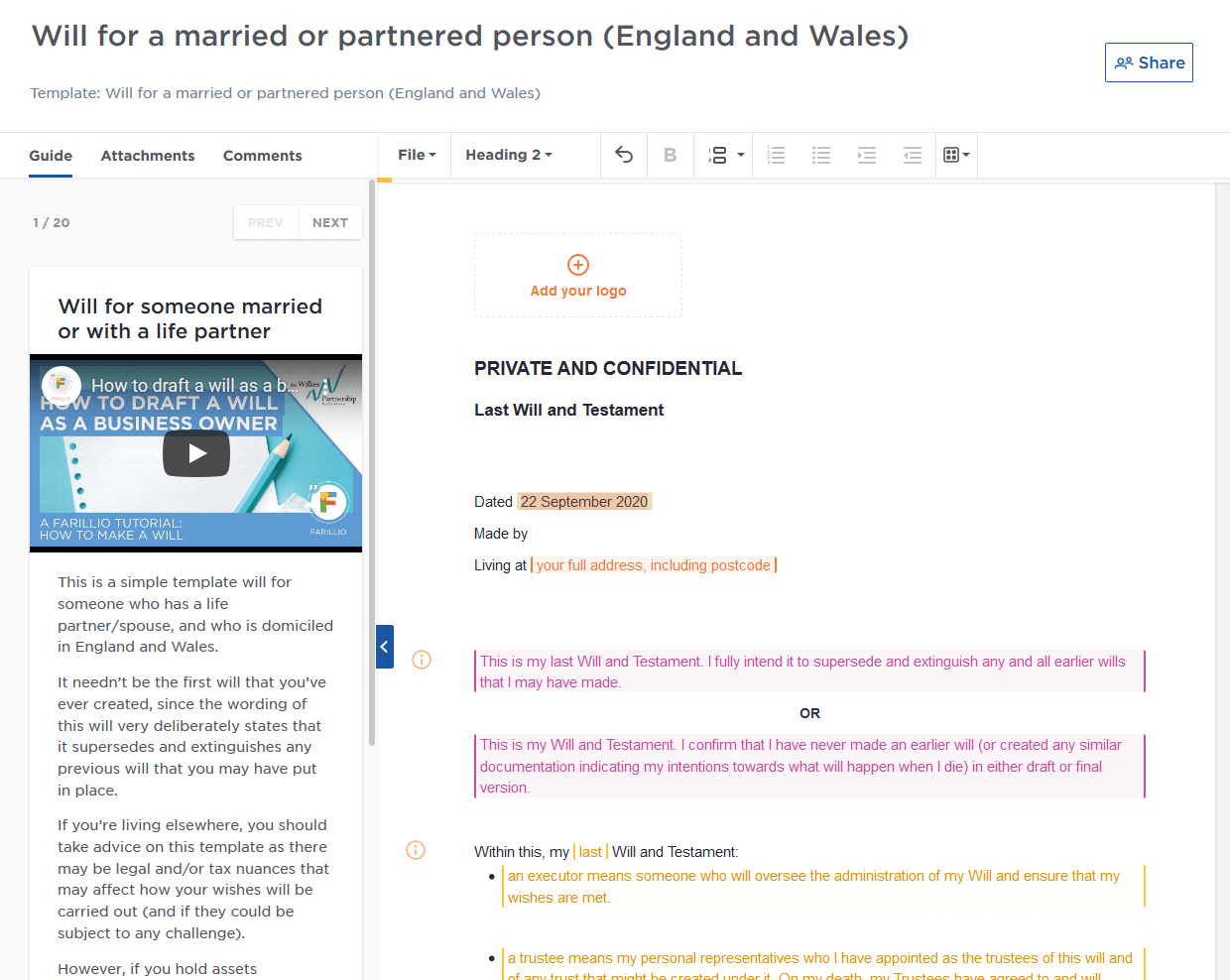

Creating your own will

The primary benefit of putting together your own will is that you can avoid the costs associated with hiring a solicitor or will writer. This may be a good option for you if your estate is quite simple.

However, putting together a will without a trained legal eye to look at it can be risky – it means that you could make a critical mistake and be completely unaware. If you do create your own will, take the utmost care to be as specific as possible.

If you are a DAS customer, you may have access to a range of will writing templates through DAS Householdlaw. This will help you ensure you have included everything you need in the will, with helpful guidance for every section.

Visit DAS Householdlaw

Hiring a professional will writer

If finances allow, it may be worth using a professional will writer or will writing service to guide you through the process, particularly if you have a large or complex estate.

A will writer is likely to be the less expensive option of the two, however, you should be careful when choosing a will writer, as they are not required to have any qualifications, due to the lack of industry regulations.

This means that your will writer may not have any actual legal knowledge. They are also not required to have any insurance, which could cost you and your beneficiaries greatly if there is a problem with the will.

It would be safest to find a will writer who is a member of an organisation such as the Institute of professional will writers, which requires all members to be fully qualified and insured.

Hiring a will solicitor

A dedicated will solicitor will probably be more expensive than a will writer, but you will get the best service for your money. A solicitor will be fully qualified, and if something does go wrong, you will have the option of complaining to the solicitor’s firm and the Legal Ombudsman (LeO).

They will also be able to advise you with regards to inheritance tax, making sure that you can set up your Will to ensure that you pay as little tax as possible.

Selecting witnesses for your will

To make your will valid in the eyes of the law, it will need to be formally signed and witnessed. You will need two people to witness you signing the will, and both witnesses must:

- Be over the age of 18

- Not be receiving anything in your will, or be married to someone who is.

Witnesses do not need to read the will itself – all they are witnessing is your signature. Once you have signed the will, they must both sign the will (and print their addresses) in your presence. The witnesses must add their signatures after you have added yours, and they must both be present for each other's signature.

Failing to follow these rules to the letter could leave your will open to a challenge down the road.

Storing your will

Storing your will in a safe place is vital. Any damage to the document could lead people to challenge its validity. You could keep the will at home, but this means that it can be vulnerable to any number of hazards – if there is a fire or a flood in your home, for example, the will could be destroyed. It may also be difficult to find once you have passed away.

If you want your will to be stored somewhere more secure, there are organisations which provide storage for wills – for a price.

The benefits of using a solicitor

One of the many benefits of using a solicitor to create your will, is that many solicitors will offer free storage to clients who make their wills with them. However, bear in mind that it may be difficult to find your will if the solicitor or will writer moves or stops trading. Also, if you didn’t use the solicitor to create your will, you will have to pay a fee for storage.

Storing with a solicitor or will writer comes with many of the same pros and cons as having a will professionally created for you – storing with a will writer will be cheaper than storing with a solicitor, but it will give you less security.

Storing your will at a bank

Your bank may be able to store your will, usually for a fee of around £10-£25 a year. If you choose this option, you should let your executors know exactly where it is, as this could create some confusion if you have accounts with a number of different banks.

Using a dedicated storage facility

There are a number of private companies devoted to storing wills which offer you insured secure facilities. These facilities are often regarded as very reliable and secure. The fees will depend on the subscription you choose and are most often charged annually. This also allows your will to be updated at no extra charge.

You can store your will and any codicils (corrections to the will) at the Principal Probate Registry through the Probate service. You can do this by bringing the will to the Principal Probate Registry in London, or by sending it to them in the post at the following address:

The Principal Probate Registry

7th Floor

First Avenue House

42-49 High Holborn

London

WC1V 6NP

You will need to pay a fee of £20 for every submission. If you submit a will and a codicil together, you will only need to pay once, but any codicils submitted later will require extra fees.

If you send the will by post, you will need to get a safe custody will envelope pack from your nearest probate registry. You will also need a witness to sign the envelope before it is sent. Once the will has been stored, you will receive a Certificate of Deposit, which you will need if you wish to withdraw the will during your lifetime.

Making changes to your will

It is possible to make changes to a will without writing a completely new one, should any of your circumstances change.

Changes to your will can be made by creating a codicil. This is made in much the same way as a will – you will need two witnesses to the codicil, although they do not need to be the same as those who witnessed the will itself.

Depending on the nature and significance of the change you wish to make, it may be more appropriate to make a new will instead of just changing it. For example, if you want to add or remove a main beneficiary, or you wish to make a number of changes, it may be better to create a new will.

Creating a new will can also help to minimise any confusion, as well as preventing beneficiaries from seeing what changes were made. However, it is likely to be more expensive. If you do make a new will, it should begin with a clause that revokes all previous wills. You should destroy any copies of your old will to make it clear that it is no longer valid.

Your reasons for changing the will could vary – it could be due to changes in the circumstances or your relationships with your beneficiaries, or just a change of heart. Alternatively, if your estate has changed significantly since the will was drawn up, it may be necessary to make changes, especially if you want to reduce the amount of tax that will need to be paid.

However, there are certain circumstances in which a change to your will is highly recommended, such as when a new child is born or adopted into your family, or if you divorce from your spouse or civil partner.

When you get married, your will automatically becomes invalid, unless special provision was made for the impending marriage when the will was created. Getting divorced will not invalidate your will, but it will cancel out any part which names your former spouse as a beneficiary or executor.

Need more help?

DAS UK customers have access to templates and guides on dashouseholdlaw.co.uk, including a number of templates for both single and mirror wills.

You can access DAS Householdlaw by using the voucher code in your policy provider’s documentation.

Visit DAS Householdlaw

Disclaimer: This information is for general guidance regarding rights and responsibilities and is not formal legal advice as no lawyer-client relationship has been created. Note that the information was accurate at the time of publication but laws may have since changed.